Why Documents Are Required

Banks require documentation to verify your identity, ensure compliance with legal regulations, and protect against fraud. These documents help banks confirm that you are who you claim to be and that your funds are legitimate.

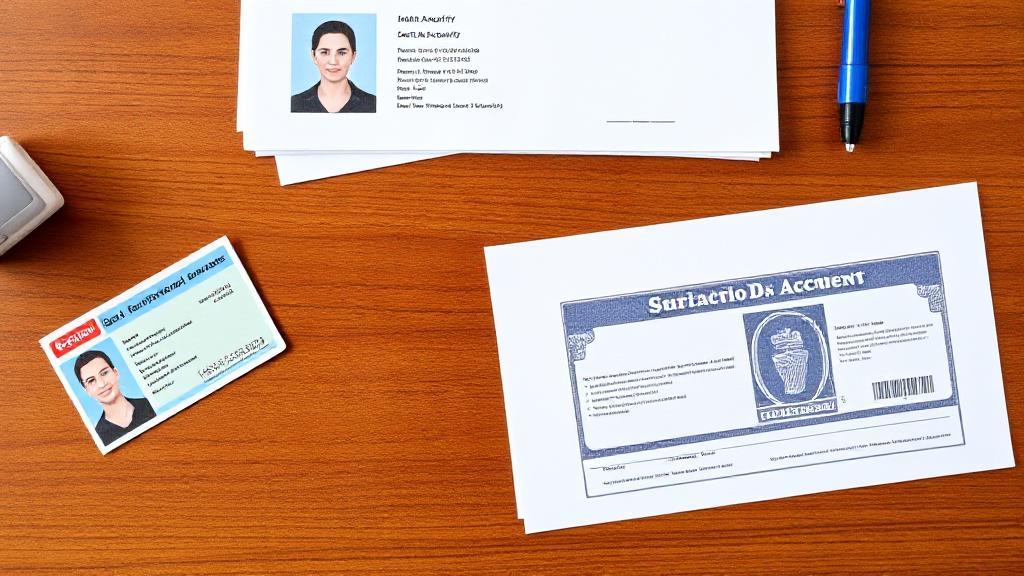

Primary Identity Documents

A valid government-issued photo ID is essential. Acceptable forms include:

- Passport

- Driver's License

- State ID Card

- Military ID

Proof of Address

You'll need recent documents (usually within 60-90 days) showing your current residential address:

- Utility Bills (electricity, water, gas)

- Lease or Rental Agreement

- Bank Statement from another financial institution

- Property Tax Statement

- Government Correspondence

Social Security Verification

- Social Security card

- Official document showing your Social Security number

- W-2 form from employer

For non-US citizens:

- Valid passport

- Immigration documents (visa, green card)

- Form W-8BEN

Special Account Types

Joint Accounts

- Identification for all account holders

- Proof of relationship (if applicable)

Business Accounts

- Business License

- Partnership Agreement (for partnerships)

- Articles of Incorporation (for corporations)

- Employer Identification Number (EIN)

- DBA certificate

Student Accounts

- Student ID

- Proof of Enrollment

Initial Deposit Requirements

| Account Type | Typical Minimum Deposit |

|---|---|

| Basic Checking | $25-$100 |

| Premium Checking | $100-$500 |

| Savings Account | $25-$100 |

| Business Account | $100-$1,000 |

Digital Banking Considerations

For online account opening, you'll need:

- Digital copies of identification documents

- Ability to upload clear photos/scans

- Valid email address

- Working phone number for verification

Important Note: Requirements may vary by bank and account type. It's recommended to check with your chosen financial institution for their specific requirements before visiting.

Tips for a Smooth Process

- Check the bank's website for specific requirements

- Prepare originals and copies of documents

- Schedule an appointment to save time

- Ensure all documents are current and not expired

- Bring multiple forms of ID if possible

For more information, visit:

- FDIC Consumer Resource Center

- Consumer Financial Protection Bureau (CFPB)

- Federal Trade Commission (FTC)

Remember that maintaining accurate and up-to-date documentation helps protect both you and the financial institution from identity theft and fraud.