Understanding Filing Statuses

Single Filing Status

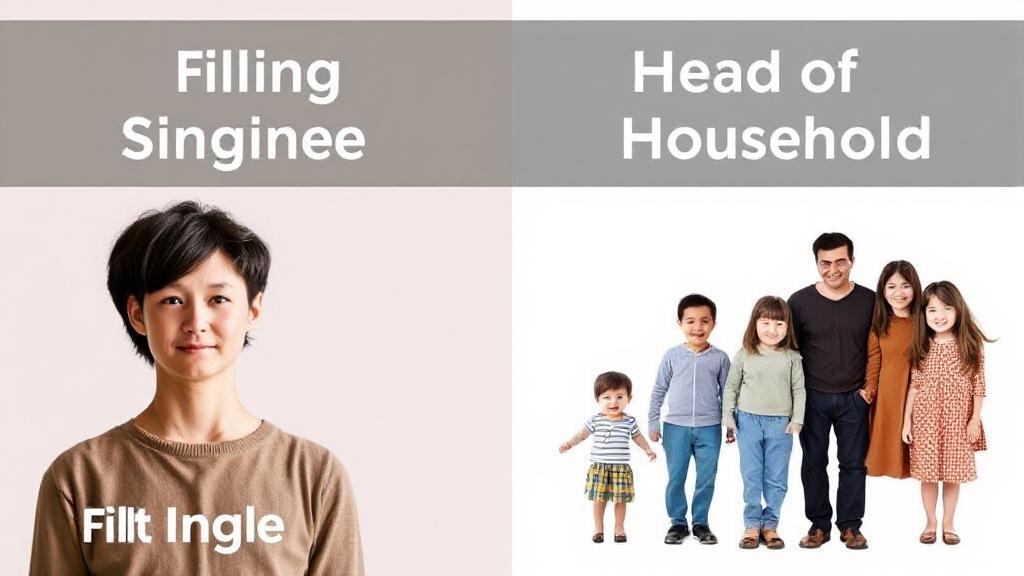

The Single filing status applies to unmarried individuals or those legally separated according to state law by the last day of the tax year. This status is typically used by individuals without dependents.

Key Points:

- Standard Deduction: $13,850 for tax year 2023

- Tax Rates: Generally higher compared to Head of Household

- Eligibility: Must be unmarried or legally separated

Head of Household Filing Status

The Head of Household (HOH) status offers more favorable tax treatment for unmarried individuals who provide a home for certain other people.

Key Points:

- Standard Deduction: $20,800 for tax year 2023

- Tax Rates: More favorable than Single filers

- Eligibility: Must be unmarried, pay over half of home maintenance costs, and have a qualifying person living with you for more than half the year

Qualifying for Head of Household

To qualify as Head of Household, you must meet three primary requirements:

- Be unmarried or considered unmarried on the last day of the tax year

- Pay more than half the cost of maintaining your home

- Have a qualifying dependent who lives with you for more than half the year

Important Note: Simply being single with dependents doesn't automatically qualify you for HOH status. The IRS has specific guidelines about who counts as a qualifying person.

Financial Impact Comparison

Tax Savings Example

| Filing Status | Standard Deduction | Taxable Income | Estimated Tax |

|---|---|---|---|

| Single | $13,850 | $36,150 | $4,097 |

| HOH | $20,800 | $29,200 | $3,183 |

Common Mistakes to Avoid

Head of Household Errors

- Claiming HOH status while married

- Not having a qualifying dependent

- Counting a dependent who doesn't live with you

- Failing to provide more than 50% of household support

Single Filing Errors

- Missing out on HOH status when eligible

- Not updating status after life changes

- Incorrectly claiming dependents

Making Your Decision

Consider these factors when choosing your filing status:

-

Current Living Situation

- Do you live alone?

- Do you support any dependents?

-

Financial Responsibilities

- Are you paying more than half of household expenses?

- Do you provide significant support for any dependents?

-

Marital Status

- Are you legally married?

- Are you divorced or separated?

Benefits of Filing as Head of Household

Filing as Head of Household provides several advantages:

- Higher standard deduction, reducing your taxable income

- Lower tax rates compared to Single status

- Potential eligibility for additional tax credits, such as the Earned Income Tax Credit (EITC)

Getting Professional Help

If you're unsure about your filing status, consider consulting a tax professional. The IRS Interactive Tax Assistant can help determine your correct filing status.

For more detailed information, visit:

Remember that your filing status can change from year to year based on your circumstances. Always review the requirements annually to ensure you're choosing the most advantageous status for your situation.