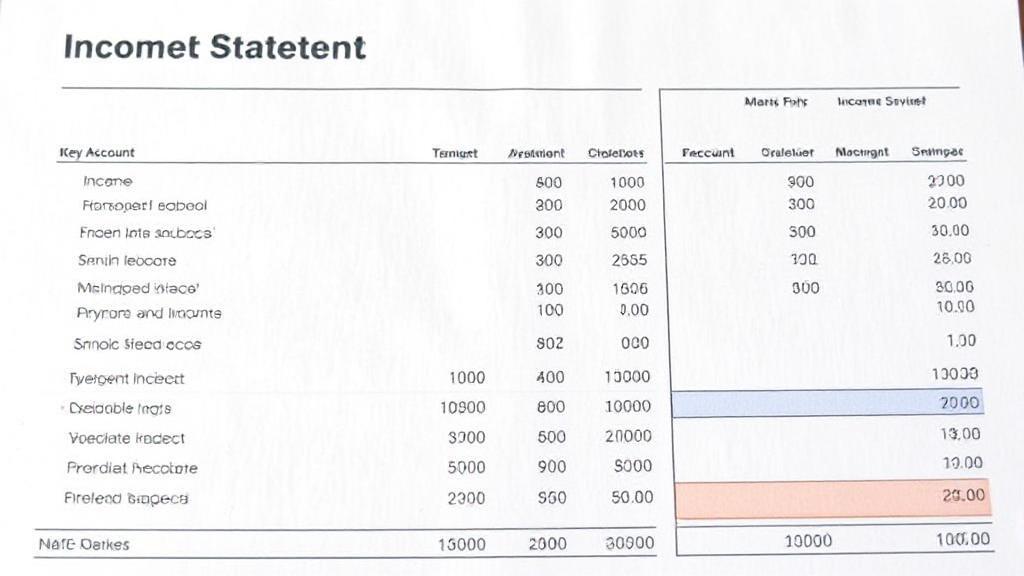

Understanding Key Accounts on an Income Statement

An income statement, also known as a profit and loss statement (P&L), is a crucial financial document that summarizes a company's revenues, expenses, and profits over a specific period. It is one of the three main financial statements used by businesses, alongside the balance sheet and cash flow statement.

Major Components

1. Revenue (Sales)

Revenue represents the total amount earned from selling goods or services before any deductions. This includes:

- Gross sales

- Service revenue

- Rental income

- Interest income

- Other operating revenue

2. Cost of Goods Sold (COGS)

COGS represents the direct costs associated with producing goods or delivering services:

- Raw materials

- Direct labor

- Manufacturing overhead

- Freight-in costs

- Factory utilities

3. Gross Profit

Calculated as Revenue - COGS, gross profit shows how efficiently a company produces its goods or services. A higher gross profit margin typically indicates better operational efficiency.

4. Operating Expenses

Selling Expenses

- Sales salaries and commissions

- Advertising and marketing costs

- Travel expenses

- Sales office costs

General and Administrative Expenses

- Office salaries

- Utilities

- Insurance

- Professional fees

- Depreciation and amortization

5. Operating Income

Operating income, or Earnings Before Interest and Taxes (EBIT), equals gross profit minus operating expenses. This figure excludes income from non-operating activities, taxes, and interest expenses.

6. Non-Operating Items

Other Income

- Investment gains

- Interest earned

- Rental income (if not part of main operations)

- Foreign exchange gains

Other Expenses

- Interest expense

- Losses from asset sales

- Foreign exchange losses

7. Net Income

Net income, also known as the "bottom line," is the final profit or loss after all revenues, expenses, and taxes.

Special Considerations

Extraordinary Items

While rare, these are unusual and infrequent events that can significantly impact financial statements:

Natural disasters Asset write-offs Restructuring costs

Discontinued Operations

Income or losses from business segments that have been or will be terminated should be reported separately.

Key Metrics and Ratios

Common ratios derived from income statement accounts include:

| Ratio | Formula | What It Measures |

|---|---|---|

| Gross Margin | Gross Profit / Revenue | Operational efficiency |

| Operating Margin | Operating Income / Revenue | Core business profitability |

| Net Profit Margin | Net Income / Revenue | Overall profitability |

Importance and Uses

Understanding these key accounts is vital for:

- Making informed business decisions

- Comparing performance across periods

- Benchmarking against competitors

- Identifying areas for improvement

- Planning for future growth

For further reading, you might explore: