Understanding the W-2 Form Layout

The W-2 form, officially known as the "Wage and Tax Statement," is a crucial document that employers must provide to their employees and the Internal Revenue Service (IRS) by the end of January each year. It summarizes an employee's earnings and taxes withheld during the previous tax year.

Key Sections and Organization

The W-2 form is divided into several boxes, labeled with both letters and numbers:

- Boxes A-F: Contains personal and employer information

- Boxes 1-20: Details financial information, including wages, tips, and various withholdings

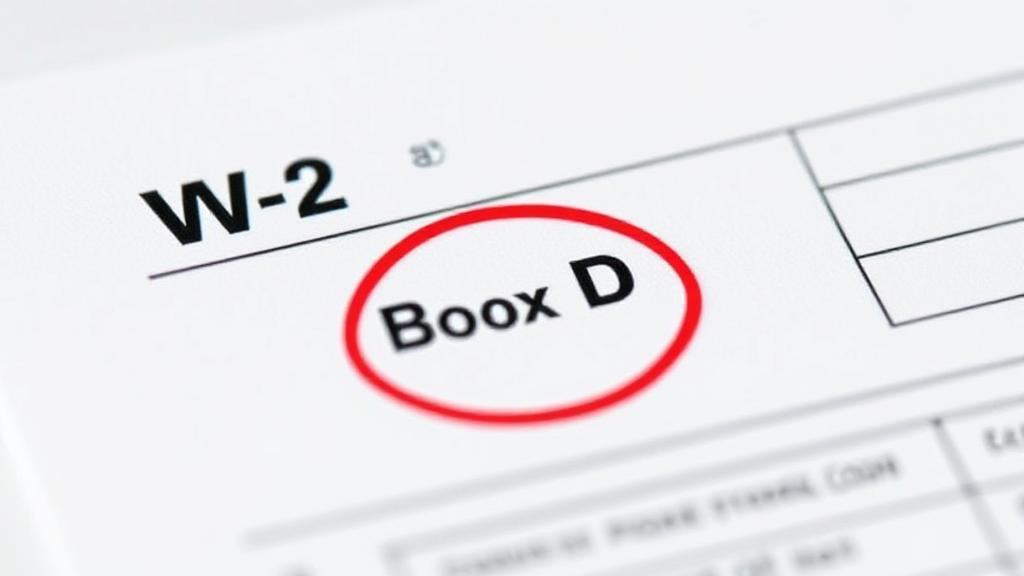

Location and Purpose of Box D

Box D is situated in the upper portion of the W-2 form, specifically in the left-hand corner. Its positioning relative to other boxes is as follows:

- Above: Box C (employer information)

- Right: Box E (employee name and address)

- Below: Box F (employee's Social Security number)

Understanding the Control Number

Box D contains the "Control Number," which serves several purposes:

- Internal tracking for employers

- Reference number for payroll systems

- Verification during tax processing

- Identification of individual W-2 forms

Important Considerations

The control number in Box D is optional, and many employers choose to leave this field blank. According to the IRS guidelines, employers are not required to populate this field. The presence or absence of a control number does not affect:

- The validity of your W-2 form

- Your tax filing obligations

- The processing of your tax return

When Box D is Typically Used

Companies commonly utilize Box D in these scenarios:

- Large corporations with multiple divisions

- Businesses using specific payroll software systems

- Organizations with complex accounting structures

- Companies that handle numerous W-2 forms

Practical Applications

While Box D may not be essential for tax filing purposes, it can be helpful when:

- Contacting your employer about W-2 questions

- Referencing specific forms in large organizations

- Tracking documents through payroll systems

Additional Resources

For more detailed information about the W-2 form and its components, you can visit:

These resources provide comprehensive guidance on understanding your W-2 form and ensuring accurate tax filing.

Remember: Always keep your W-2 forms in a safe place, as they are vital for completing your annual tax return, regardless of whether Box D contains a control number.