Understanding Medicare and Medicaid

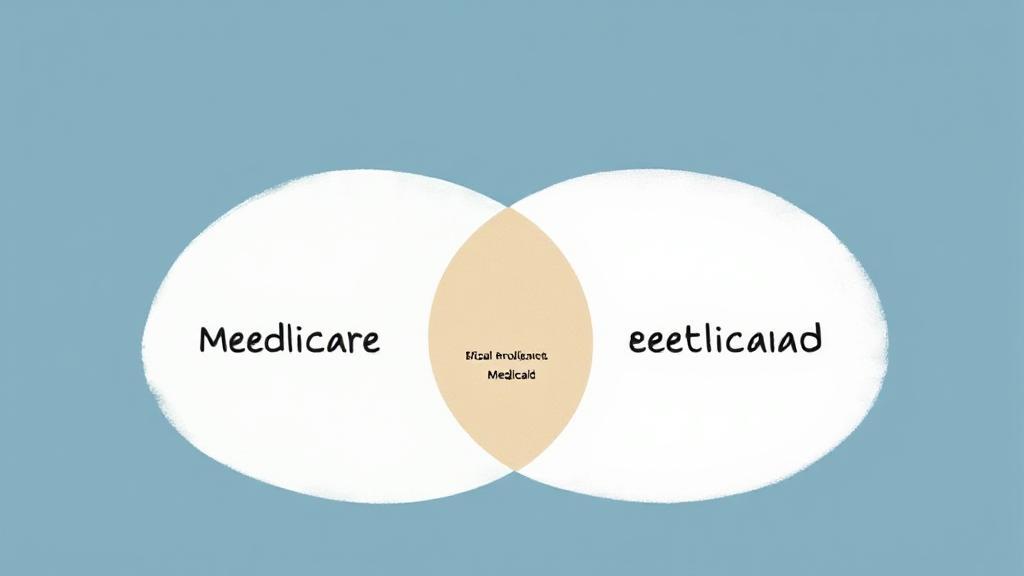

Before diving into how Medicare enrollment affects Medicaid eligibility, it's essential to understand what each program entails. Medicare is a federal health insurance program primarily for people aged 65 and older, although younger individuals with disabilities or specific diseases may also qualify. On the other hand, Medicaid is a joint federal-state program that provides health coverage to low-income individuals and families.

Key Differences

- Medicare is age-based and not income-dependent

- Medicaid is income-based and can cover a broader range of services

For more detailed information, you can visit the Medicare official site and the Medicaid official site.

Dual Eligibility and Its Impact

According to the Centers for Medicare & Medicaid Services, approximately 12 million Americans are dual-eligible beneficiaries. These individuals can receive benefits from both programs, which can significantly reduce out-of-pocket healthcare costs.

Benefits of Dual Eligibility

- Medicare Savings Programs (MSPs): Help pay for Medicare premiums, deductibles, and coinsurance

- Extra Help: Assistance with prescription drug costs under Medicare Part D

- Coverage Gaps: Medicaid can help fill coverage gaps left by Medicare, such as long-term care services

Medicare Savings Programs (MSPs)

These programs help low-income Medicare beneficiaries with Medicare costs while maintaining Medicaid eligibility:

- Qualified Medicare Beneficiary (QMB)

- Specified Low-Income Medicare Beneficiary (SLMB)

- Qualifying Individual (QI)

- Qualified Disabled and Working Individual (QDWI)

State-Specific Considerations

"Medicaid eligibility rules vary by state, so it's essential to check with your local Medicaid office for specific requirements." - National Council on Aging

Common State Variations

Important Deadlines and Documentation

Medicare Enrollment Periods

- Initial Enrollment Period (IEP)

- General Enrollment Period (GEP)

- Special Enrollment Periods (SEPs)

Required Documentation

- Proof of income

- Bank statements

- Medicare card

- Social Security information

- Proof of residence

Managing Your Coverage

Tips for Maintaining Coverage

- Report all income changes promptly

- Keep accurate records of all healthcare-related expenses

- Respond to all renewal notices on time

- Stay informed about program changes

Resources for Assistance

- State Health Insurance Assistance Program (SHIP)

- Local Area Agency on Aging

- Medicare Rights Center

- Legal Aid organizations

Special Considerations for Long-Term Care

Medicare's limited coverage of long-term care makes Medicaid particularly important for those needing extended care services. Medicaid eligibility often includes:

- Look-back periods

- Asset transfer rules

- Income caps

- Spousal protections

Remember that healthcare coverage coordination between Medicare and Medicaid requires careful attention to detail and regular monitoring of eligibility requirements. Working with a qualified counselor or advocate can help ensure you maintain appropriate coverage while maximizing your benefits.